Temu’s Strategic Launch

In September 2022, Pinduoduo, a renowned force in China’s e-commerce market, made a calculated entry into the international arena with the debut of Temu. This platform, named after Pinduoduo’s motto “Team Up, Price Down,” mirrors the company’s strategy of collaborative consumption, offering lower prices through collective buying power. Temu operates under a quasi-self-operated model, a hybrid that combines elements of self-operated and third-party logistics to address common e-commerce challenges such as counterfeit goods and logistical inefficiencies.

1 Quasi-Self-Operated Model: A Game Changer

Temu’s quasi-self-operated model encompasses a comprehensive range of functions including merchant onboarding, product selection, price negotiation, marketing promotion, order processing, fulfillment, delivery, and after-sales service. Unlike traditional platforms where merchants are responsible for a broader scope of operations, Temu merchants are primarily tasked with supplying products and managing initial transport to the platform’s warehouse. Subsequent logistics and distribution responsibilities are outsourced to specialized third parties, ensuring operational efficacy.

This model somewhat replicates Amazon’s 1P system but with significantly lower entry barriers for merchants, thereby democratizing the e-commerce landscape for small and micro-businesses. Temu operates on a zero-commission and zero-deposit basis, inviting sellers from diverse categories. However, the platform maintains unilateral control over pricing, settling with sellers at predetermined supply prices.

Merchants are required to report their lowest possible prices within the categories solicited by the platform, undergo a rigorous product vetting process, and deliver to Temu’s primary warehouse in Guangdong for quality appraisal. Following inspection, an initial supply is sent to a local warehouse in Guangzhou, ready for sale. Any unsold inventory within a 15-day window is returned to the merchant, maintaining a dynamic and responsive product lineup.

1.1 Market Positioning: A Comparative Advantage

Temu’s operational efficiencies and cost-saving measures provide it with competitive advantages over players like Shein, which is known for low merchant access costs and quick delivery times; Wish, recognized for its convenient return channels; and even Amazon, with its relatively longer delivery times and higher merchant settlement periods. Temu’s agile and merchant-friendly approach not only streamlines the sales process but also ensures a more satisfying experience for both merchants and consumers.

1.2 Temu’s Rapid GMV Growth and Product Expansion

Since its launch, Temu’s GMV has surged to $1 billion as of June 2023, propelled by strategic marketing campaigns and sales events such as Black Friday. Despite the typical post-promotion dip in consumer spending, Temu’s GMV quickly rebounded, indicating a resilient and growing platform. Additionally, Temu has achieved a notable milestone by topping the US iOS app store’s shopping category shortly after launch, signaling strong market penetration and consumer interest.

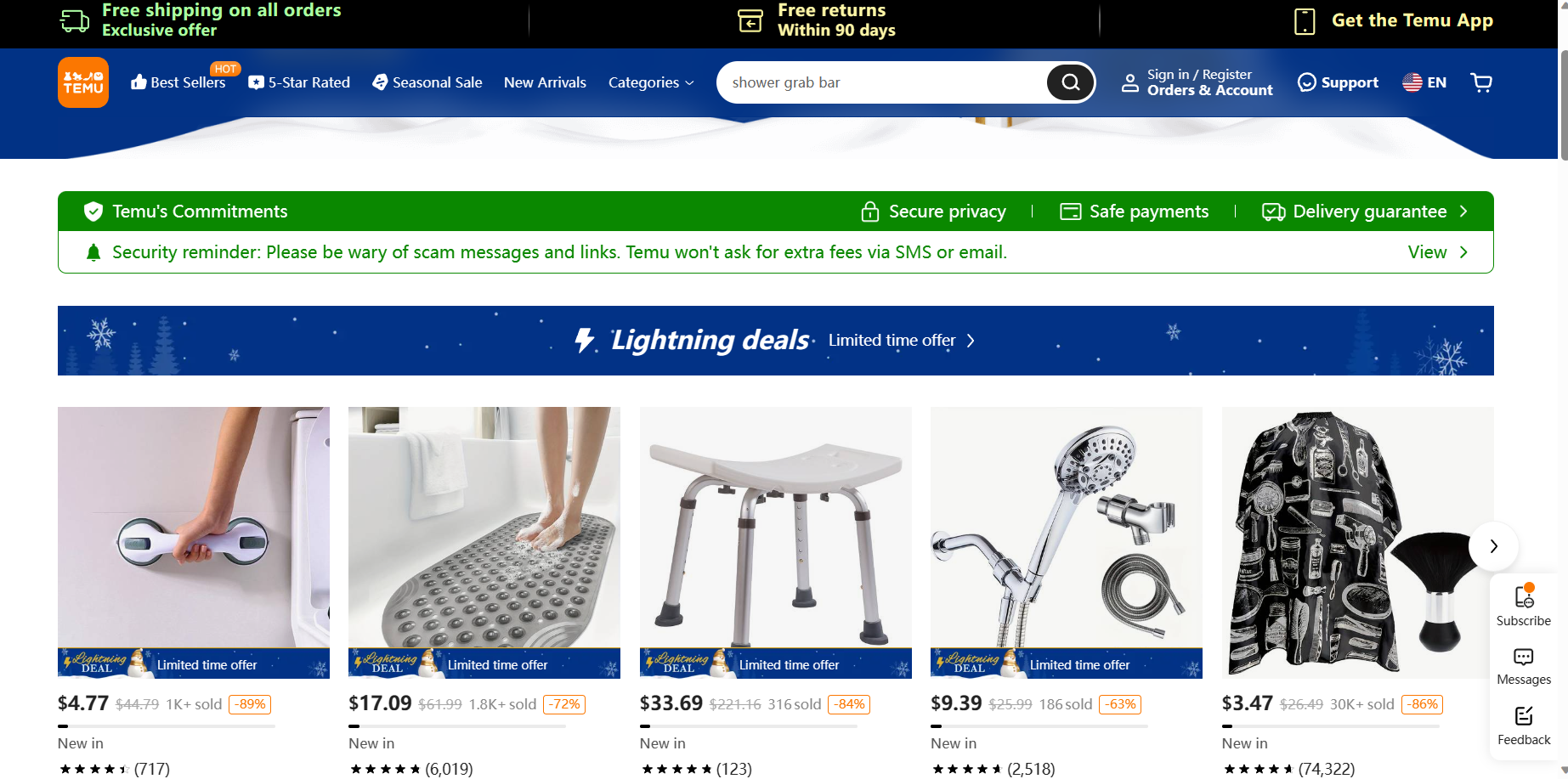

Broad Product Range: Meeting Diverse Consumer Needs

Temu’s product catalog has grown exponentially, now encompassing a wide array of categories that include but are not limited to home goods, pet supplies, apparel, jewelry, essentials, and children’s items. The balanced mix of mainstay and long-tail categories reflects the platform’s commitment to providing an extensive selection that caters to a broad consumer base.

2 Temu’s Financial Prospects and Sustainability

Temu is on a trajectory to replicate Pinduoduo’s domestic success internationally, opting for market share gains at the expense of short-term profits. Current estimates suggest a 40% loss rate, largely due to aggressive marketing and fulfillment costs. However, the platform is expected to optimize operational logistics, potentially leading to a reduced loss rate of 20% in 2024.

2.1 Assumptions Underpinning Temu’s Financial Framework

The assumption is that Temu will continue to leverage its quasi-self-operated cross-border model to drive GMV and revenue growth, without factoring in domestic e-commerce contributions. As Temu positions itself to cater to the cost-conscious consumer, it may also explore expanding its offerings through strategic subsidies in 2024.

2.2 Temu’s Calculated GMV Projections

By analyzing daily parcel volumes and average order values, Temu’s GMV for 2024 is projected to exceed $40 billion. This growth is expected to be fueled by expansion into 47 countries and regions, with a particular emphasis on diversifying away from the US GMV and tapping into the burgeoning Southeast Asian market.

2.3 After-Coupon Gross Profit Estimates

Drawing parallels with Amazon’s early consignment sales business, Temu’s after-coupon gross profit rate is assumed to be around 30% globally. This rate could differ regionally, with higher margins in Europe and the US and slightly lower in Southeast Asia. Consequently, Temu’s post-coupon gross profit is estimated to hit $12.3 billion in 2024.

Strategic Analysis of Temu’s Global E-commerce Endeavor

Temu, an extension of Pinduoduo’s innovative e-commerce model, has taken the global market by storm, combining a quasi-self-operated model with an aggressive growth strategy to establish a new paradigm in international online shopping.

1. The Genesis and Evolution of Temu

1.1 Temu’s Launch and Operational Strategy

Temu’s inception in September 2022 was a strategic move by Pinduoduo to capture the global market. The platform’s name, derived from the slogan “Team Up, Price Down,” encapsulates its mission to make shopping affordable through group buying. Temu’s quasi-self-operated model is a comprehensive ecosystem that oversees merchant integration, product curation, pricing strategies, order fulfillment, and customer service.

Quasi-Self-Operated Model: Reinventing E-commerce Logistics

At the heart of Temu’s operational excellence is its quasi-self-operated model. This framework ensures stringent quality control and combats counterfeit goods while streamlining logistics—merchants supply products and facilitate initial transport; thereafter, logistics partners manage distribution. It’s an ecosystem designed to lower the barriers for merchants, akin to Amazon’s 1P model but with significantly reduced costs and operational complexities.

Merchant and Product Dynamics

Merchants are incentivized to report competitive prices and submit products for rigorous vetting. After a quality assessment and selection process, the approved products are stocked in Guangzhou warehouses. Temu’s dynamic inventory system ensures only the best-selling products remain, with underperforming stock returned to merchants, fostering a continuously optimized product mix.

1.2 Temu’s Market Penetration and Growth

Temu’s GMV witnessed a meteoric rise, hitting the $1 billion mark by June 2023. The platform’s success was catalyzed by an aggressive marketing strategy, leveraging the Black Friday shopping frenzy in the US and quickly recovering from post-promotional declines in consumer spending. Temu’s presence has expanded across 47 countries, with a product assortment spanning 29 categories, indicating robust global growth and market acceptance.

2. Financial Trajectory and Market Prospects of Temu

2.1 Temu’s Financial Framework and Assumptions

The financial outlook for Temu is built on the premise of replicating Pinduoduo’s domestic success on the international front. The current loss rate sits at around 40%, attributed to significant marketing outlays and fulfillment costs. With a focus on refining the fulfillment logistics and possibly sustained marketing efforts, Temu’s loss rate is projected to taper to about 20% by 2024.

Key Assumptions:

Temu’s GMV and revenue growth in 2024 will predominantly stem from the cross-border quasi-self-operated model.

The platform will continue to focus on delivering value, with potential expansion into other consumer needs through strategic subsidies.

2.2 Temu’s Revenue and GMV Projections

Factoring in the daily parcel volume and the trend in average order values, Temu’s GMV for 2024 is anticipated to cross the $40 billion threshold. The platform’s expansion strategy, coupled with its diverse geographic footprint, is expected to dilute the US GMV concentration, while simultaneously elevating its profile in Southeast Asia and other regions.

2.3 Profit Projections

Temu’s after-coupon gross profit is estimated at $12.3 billion for 2024, based on a 30% global gross profit rate. This rate is expected to vary by region, with a slightly higher margin in the US and Europe and a lower margin in Southeast Asia.

3. Competitive Analysis: Temu’s Position in the E-commerce Market

Temu’s entry into the global market is characterized by its ability to offer competitive pricing, a robust supply chain, and a strong marketing strategy. It has positioned itself as a viable alternative to established players like Shein, Wish, and Amazon by offering lower costs, faster settlements, and an efficient return system.

3.1 Market Positioning and Competitive Advantages

Compared to Shein, Temu offers lower merchant costs and faster delivery times. Versus Wish, it boasts a more efficient return process. And when looking at Amazon, Temu outpaces in delivery speed and settlement times, ultimately providing an enhanced trading experience for merchants and consumers alike.

3.2 Strategic Growth and User Acquisition

Temu’s growth strategy is aligned with cultivating a user base and instilling a cost-saving mindset among consumers. As the platform matures and gains traffic, it aims to boost profitability by refining its product mix, improving warehousing and distribution, and potentially transitioning towards a platform business model.

Future Profit Paths:

Self-Operation: Direct procurement and warehousing of goods for sale through the platform.

Third-Party Sales: Temu may open its platform to other merchants, earning profits from commissions and logistics services.

Membership Services: Offering unlimited shipping perks could become a significant revenue stream.

Advertising: It is conceivable that Temu will develop an in-house advertising platform where merchants can pay to enhance product visibility.

4. Temu’s Disruptive Potential in the E-commerce Ecosystem

Temu’s unique value proposition and operational strategy have the potential to disrupt the established e-commerce order, particularly Amazon’s dominance in the US market. By focusing on price competitiveness, lower commission rates, and a streamlined channel structure, Temu could redefine consumer expectations and merchant experiences in online retail.

4.1 Differentiating Factors

Pricing Strategy: Temu’s aggressive pricing undercuts Amazon’s, targeting the more price-sensitive segments of the market.

Commission Structure: By forgoing the high commission rates that Amazon charges its third-party sellers, Temu can offer more attractive margins to merchants, which can translate into lower prices for consumers.

Channel Simplification: Temu’s quasi-self-operated model reduces the number of intermediaries between the manufacturer and the consumer, enhancing efficiency and cost-effectiveness.

4.2 Market Penetration and Expansion

Temu’s rapid expansion into dozens of countries and its impressive GMV growth are testaments to its scalable business model and its potential to capture significant market share from Amazon, especially in segments where price sensitivity is paramount.

4.3 Long-Term Sustainability and Profitability

Despite the current focus on growth over profits, Temu’s long-term sustainability will hinge on its ability to balance user acquisition with a gradual move towards profitability. This could involve diversifying its revenue streams, optimizing logistics, and potentially leveraging its scale to reduce marketing expenses as brand recognition grows.

5. Conclusion: Temu’s Trajectory and Industry Impact

Temu’s emergence as a significant player in the global e-commerce market is a story of strategic positioning, innovative logistics, and aggressive market penetration. With a projected GMV of $40 billion in 2024 and a diversified international presence, Temu stands poised to challenge established platforms by offering a compelling mix of low prices, a vast product selection, and a merchant-friendly business model.

While profitability remains a future goal, Temu’s current operations reflect a clear understanding of the cost-effective market niche and an unwavering commitment to capturing it. As Temu continues to grow and evolve, it will undoubtedly shape the dynamics of international e-commerce, potentially altering the landscape in ways that could challenge the hegemony of current market leaders like Amazon.

In conclusion, Temu’s foray into the e-commerce space is not just another market entry; it’s a strategic incursion aimed at reshaping consumer behavior and merchant operations on a global scale. With meticulous execution and strategic agility, Temu could well be on its way to becoming a household name synonymous with affordable, quality online shopping, presenting a formidable challenge to the status quo of the e-commerce giants.